Mortgage Guide: VA, FHA & Conventional Loans Explained Understanding mortgage options doesn’t have to be…

30 Factors Influencing Mortgage Interest Rates

30 Key Factors That Influence Mortgage Interest Rates

Mortgage rates may seem unpredictable, but they’re influenced by various economic and personal factors. Understanding them helps you make informed, confident decisions when financing a home.

Whether buying your first home or refinancing, it pays to know what affects your mortgage rate. Here are 30 of the most common drivers:

Whether buying your first home or refinancing, it pays to know what affects your mortgage rate. Here are 30 of the most common drivers:

- Federal Reserve Rates: The Fed’s interest rate policy affects lending costs across the board.

- Inflation: Rising inflation often pushes mortgage rates higher.

- Economic Growth: A strong economy usually leads to higher interest rates due to increased demand.

- Unemployment Levels: Higher unemployment can lead to rate cuts to stimulate the market.

- Government Debt: Countries with higher national debt may face upward pressure on rates.

- Monetary Policy: Central bank policies directly affect lending rates.

- Stock Market Trends: Strong markets can pull investor funds away from bonds, causing mortgage rates to rise.

- Global Economic Events: Global instability or recessions can influence U.S. mortgage markets.

- Housing Market Demand: More buyers competing for fewer homes often leads to higher rates.

- Loan-to-Value (LTV) Ratio: A higher LTV often results in a higher interest rate.

- Credit Score: Better credit usually means lower rates.

- Debt-to-Income (DTI) Ratio: A higher DTI may lead to a higher rate.

- Property Type: Investment properties may have higher rates than primary residences.

- Loan Amount: Jumbo loans (those above conventional limits) often carry higher rates.

- Loan Term: Shorter-term loans generally offer lower interest rates.

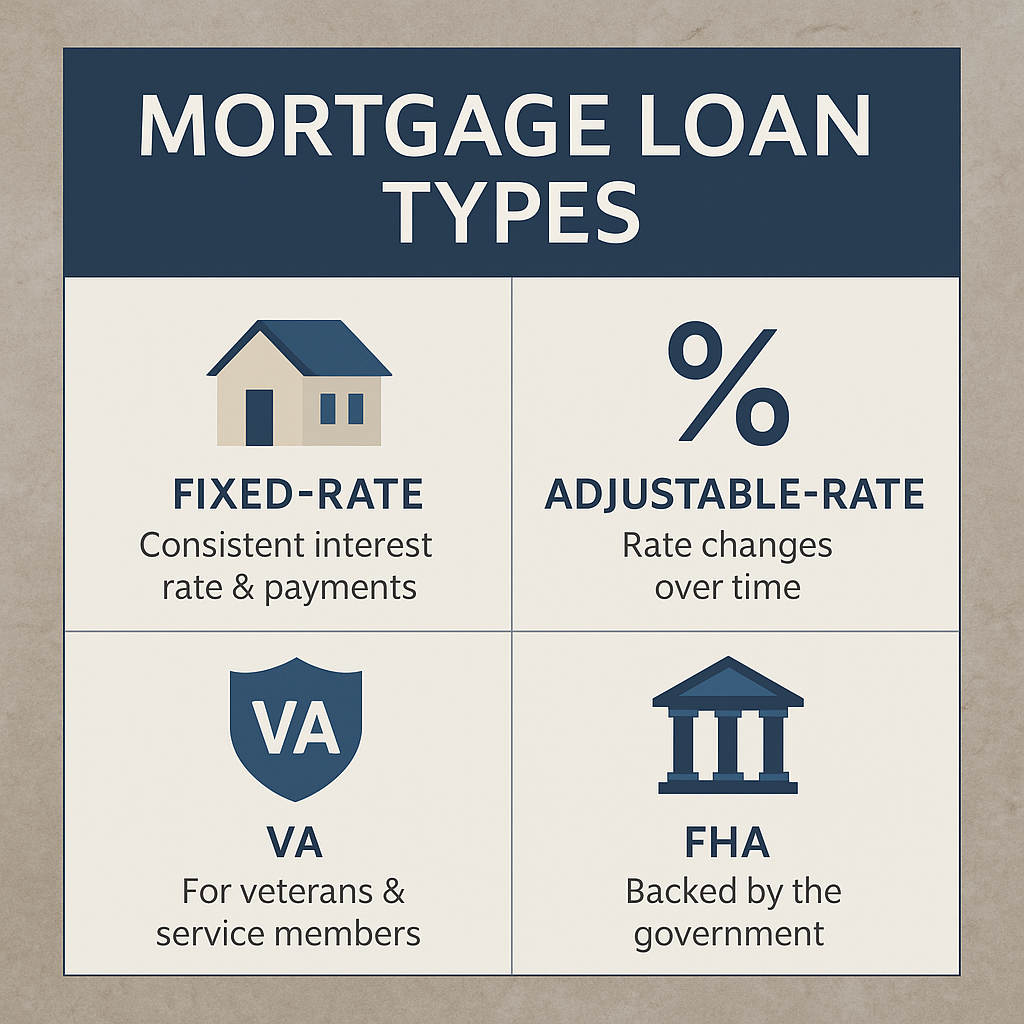

- Fixed vs. Adjustable Rates: Adjustable-rate mortgages (ARMs) typically start lower but may increase over time.

- Discount Points: Paying points upfront can reduce your rate.

- Loan Program: Different programs, such as FHA, VA, USDA, and conventional, have different rate structures.

- Secondary Market: Mortgage-backed securities pricing influences rates.

- Lender Overhead: Internal lender costs and desired margins affect rate offerings.

- Market Competition: More competition between lenders usually leads to better rates for consumers.

- Refinancing Trends: When many refinance, lenders may adjust pricing models.

- Regulatory Policy: Changes in lending regulations can impact how rates are set.

- Employment History: A stable job history can result in better rate offers.

- Rate Lock Period: Longer rate locks may come at a premium.

- Down Payment Size: Larger down payments often lead to lower rates.

- Property Use: Second homes or rentals may have slightly higher rates.

- Geographic Location: Rates can vary by state and metro area.

- Mortgage Insurance: Required insurance on low-down-payment loans can impact the effective cost.

- Key Economic Indicators: Reports like the Consumer Price Index and jobs data move markets and rates.

Make Sense of Your Options

If you’d like to discuss your specific situation or determine how much home you can afford, I’m here to help. Let’s discuss what matters most to you and find a mortgage that fits.

Contact me for a personalized review, or start your application online.