Have you been waiting for the perfect time to jump into the housing market? If…

Key Advantages of Buying a Home Soon

There’s no doubt that buying a home today is different than it was a couple of years ago, and the market shift has resulted in advantages for buyers today. Right now, there are specific reasons why this housing market is appealing to those who have considered buying but have put off their search due to rising mortgage rates.

Purchasing a home in any market is a personal decision, and the best way to make that decision is to educate yourself on the facts rather than following sensationalized headlines in today’s news. The truth is that headlines do more to frighten people who are thinking about buying a home than they do to clarify what’s going on in the real estate market.

Here are three reasons why prospective homebuyers should act now.

1. More Homes Are for Sale Right Now

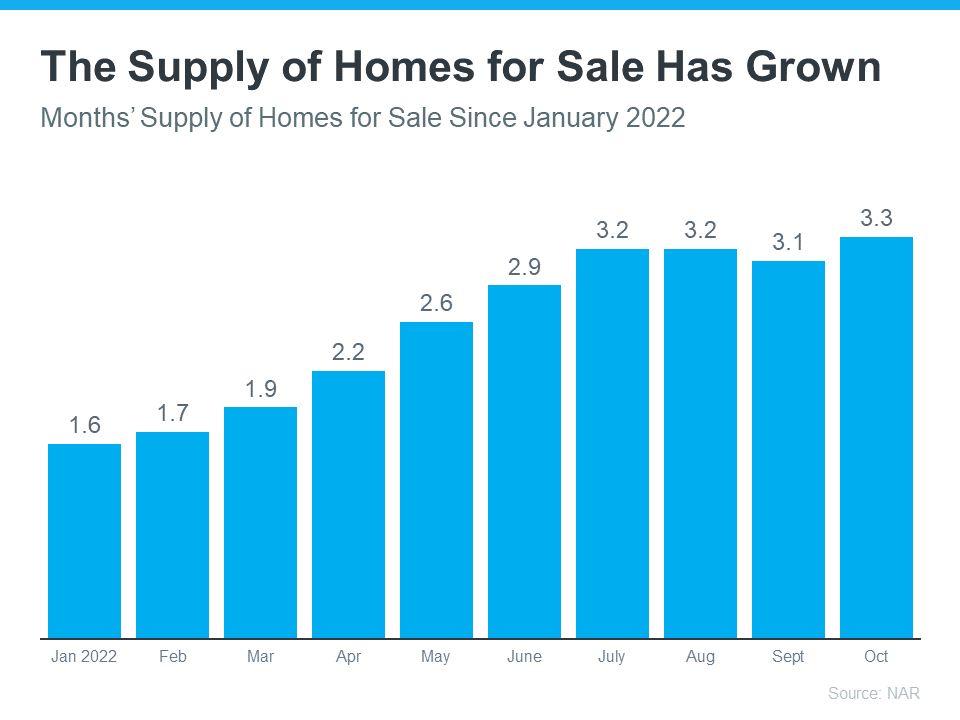

According to data from the National Association of Realtors (NAR), this year, the supply of homes for sale has grown significantly compared to where we started the year (see graph below):

This increase has occurred due to two factors: homeowners listing their homes for sale and homes remaining on the market for a longer period of time as buyer demand has moderated in response to higher mortgage rates.

The good news is that more inventory means more options for you. When there are more homes on the market, there may be less competition from other buyers because the peak frenzy of competing for the same home has also subsided.

2. Home Prices Are Not Projected To Crash

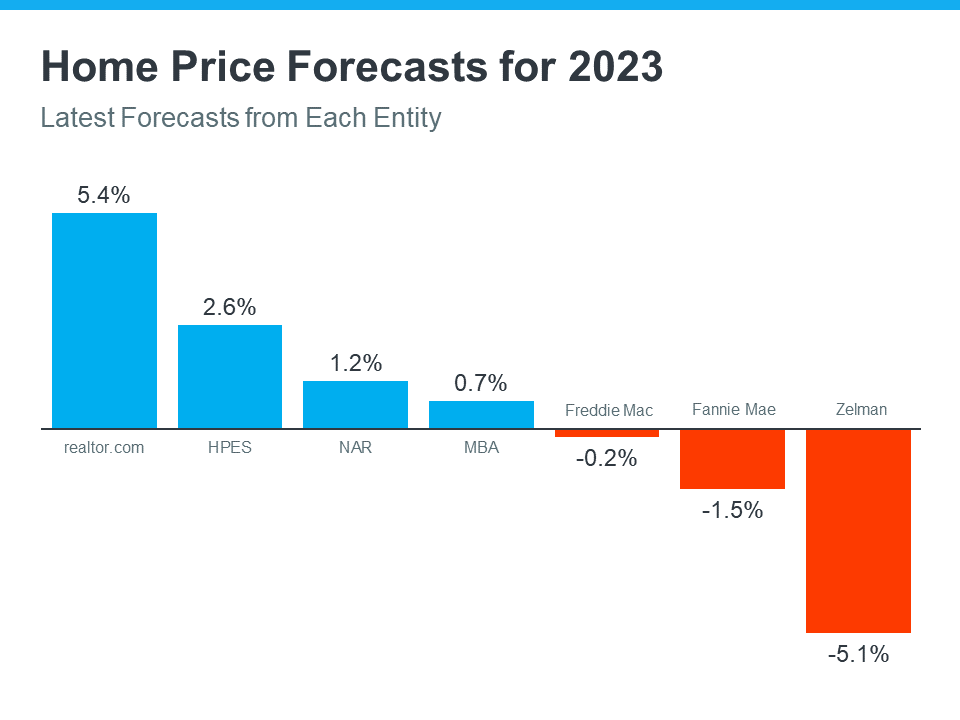

Experts don’t believe home prices will crash as they did in 2008. Instead, home prices will moderate at various levels depending on the local market and the factors, like supply and demand, at play in that area. That’s why some experts are calling for slight appreciation and others are calling for slight depreciation (see graph below):

When you look at the big picture and average the expert forecasts for 2023, you can expect relatively flat or neutral price growth next year. So, if you’re hesitant to buy a home because you’re afraid prices will plummet like they did in 2008, rest assured that’s not what experts predict.

3. Mortgage Rates Have Risen, but They Will Come Down

While mortgage rates have risen dramatically this year, the rate of increase has slowed in recent weeks as early indications suggest that inflation may be slowing slightly. What happens next with inflation will largely determine where they go from here. If inflation begins to slow, mortgage rates may fall as a result.

When this occurs, expect more buyers to return to the market. That means you’ll be up against more competition once more. Purchasing a home now, before more buyers return to the market, may put you one step ahead. As Lawrence Yun, Chief Economist for NAR, says:

“The upcoming months should see a return of buyers, as mortgage rates appear to have already peaked and have been coming down since mid-November.”

Those waiting on the sidelines will jump back in when mortgage rates come down. Your advantage is getting in before they do.

Bottom Line

If you are considering purchasing a home, you should carefully consider the benefits that today’s market has to offer. Let’s get together so you can make your dream of home ownership a reality.